MarketXLS offers a set of stock drawdown functions, which save you a lot of tedious work which would be needed to calculate MDD for even a single stock.

Visual of maximum drawdown stocks how to#

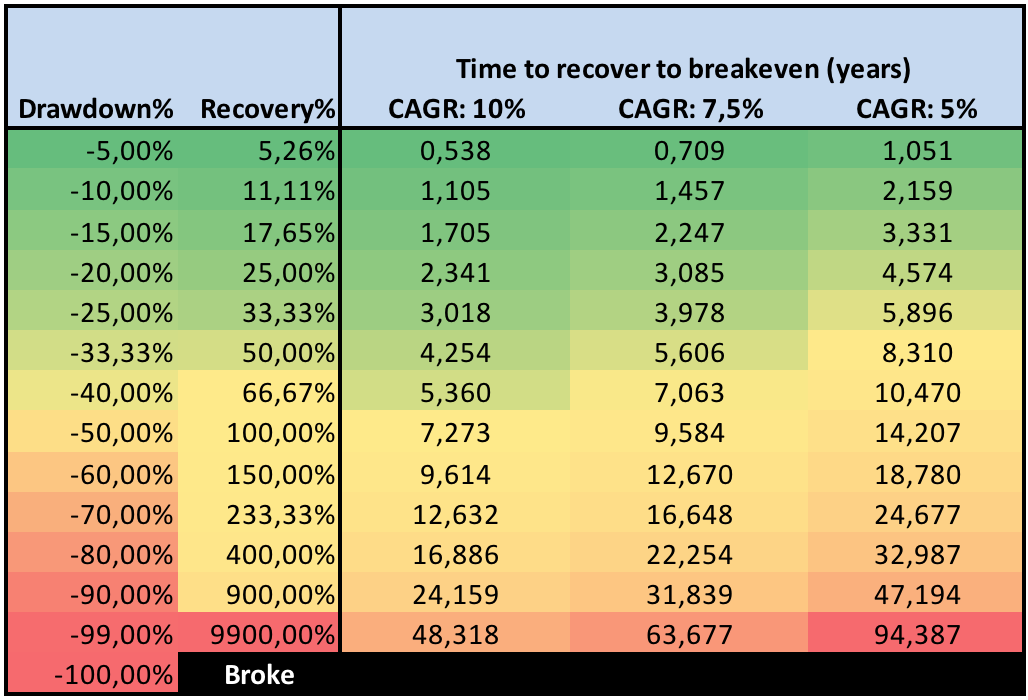

How to use Stock drawdown functions in MarketXLS Our goal is to pick investment opportunities with the least amount of downside risk, for the expected return potential. While it is measured daily, as investors and/or analysts we are interested in the maximum drawdown (MDD) over the observed period. Here is a chart of daily drawdowns for AAPL: It is always a negative number unless a new high for the stock is attained, in which case the value of drawdown is zero. We shall demonstrate how drawdown works by using daily closing prices of AAPL stock, adjusted for stock splits and dividends.īetween the beginning of 2012 and the time of writing this post (November 2019), AAPL stock has experienced three major drawdowns, with the stock price declining 43.8%, 30.4%, and 38.5%, respectively, from the prior peaks.ĭrawdown percentage is the answer to the question: if someone had bought this investment at the time of its highest price, and later sold it at the bottom, just before the investment price began to recover, how much had he lost? In other words, a drawdown represents the worst-case scenario which an investor into a particular portfolio, fund, or stock could have experienced, over the defined time period.ĭrawdown is measured on a daily level. We at MarketXLS believe that risk measures, which focus exclusively on the downside, are more relevant to investors. This means that the traditional measures will penalize a stock that has consistently outperformed the market, and they will mark such a stock as “risky”. The problem with both of these measures is that they treat both positive and negative deviation from the average market return as factors that increase risk. Traditional measures of risk in investing are beta and the Sharpe ratio. It is typically quoted as the percentage between a peak and the subsequent trough. A drawdown is defined as a peak-to-trough decline over a specified time period for an investment (a portfolio of stocks, bonds, a fund, or individual stock or bond). It is both highly useful when analyzing a potential investment and also easy to understand for professionals and non-professionals alike. A drawdown (usually understood as maximum stock drawdown) is an indicator of downside risk over a specified period of time.

0 kommentar(er)

0 kommentar(er)